Case Study: How JPS Develops Delivered an 82× ROI

A national storage company • Managed by JPS Develops

The Challenge

A national storage provider wanted to accelerate growth through paid advertising, but leadership needed clarity on the true ROI—not just top-of-funnel leads, but profitability after factoring in media spend and JPS Develops’ management fees.

The Strategy

- Unified reporting that combined lead source performance with total marketing costs (ads + management).

- Benchmarked every channel against Customer LTV to ensure acquisition costs made sense.

- Scaled high-performing PPC landing pages while strengthening organic capture via website forms.

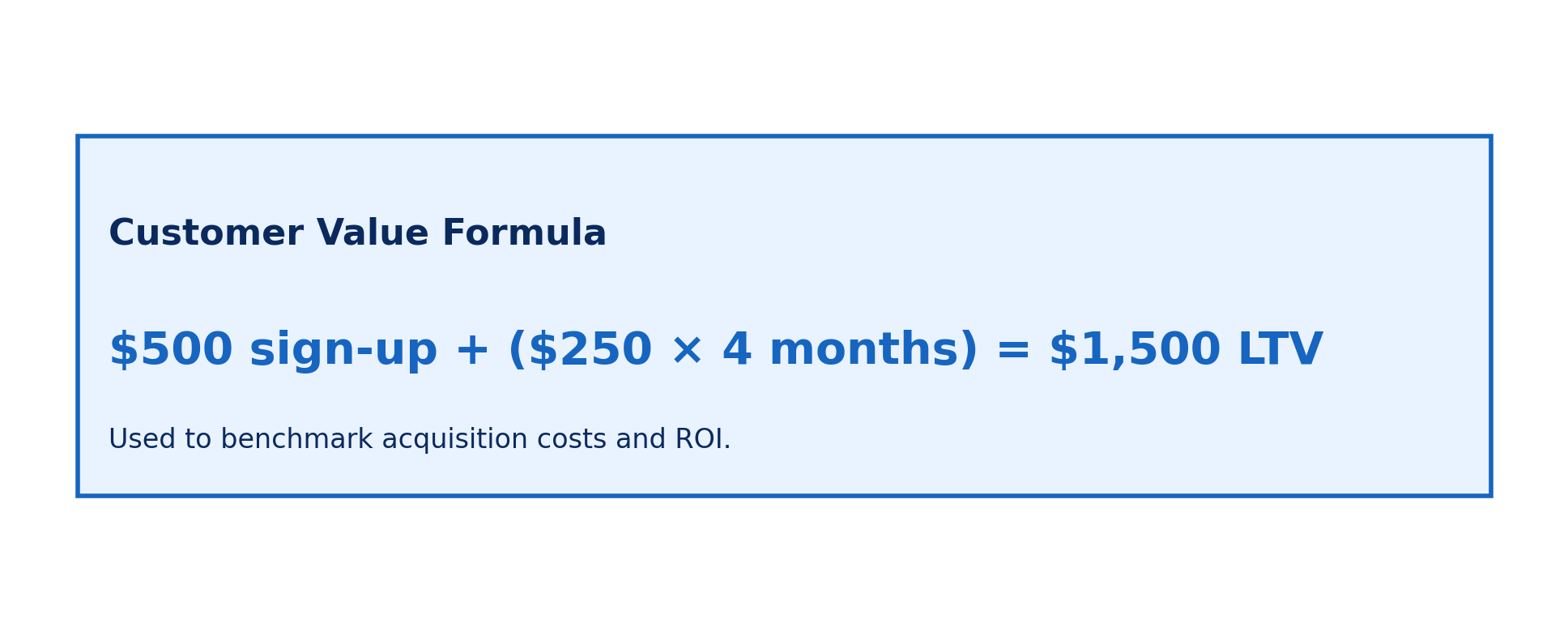

Customer Value Formula: $500 sign-up + ($250 × 4 months) = $1,500 LTV

The Results

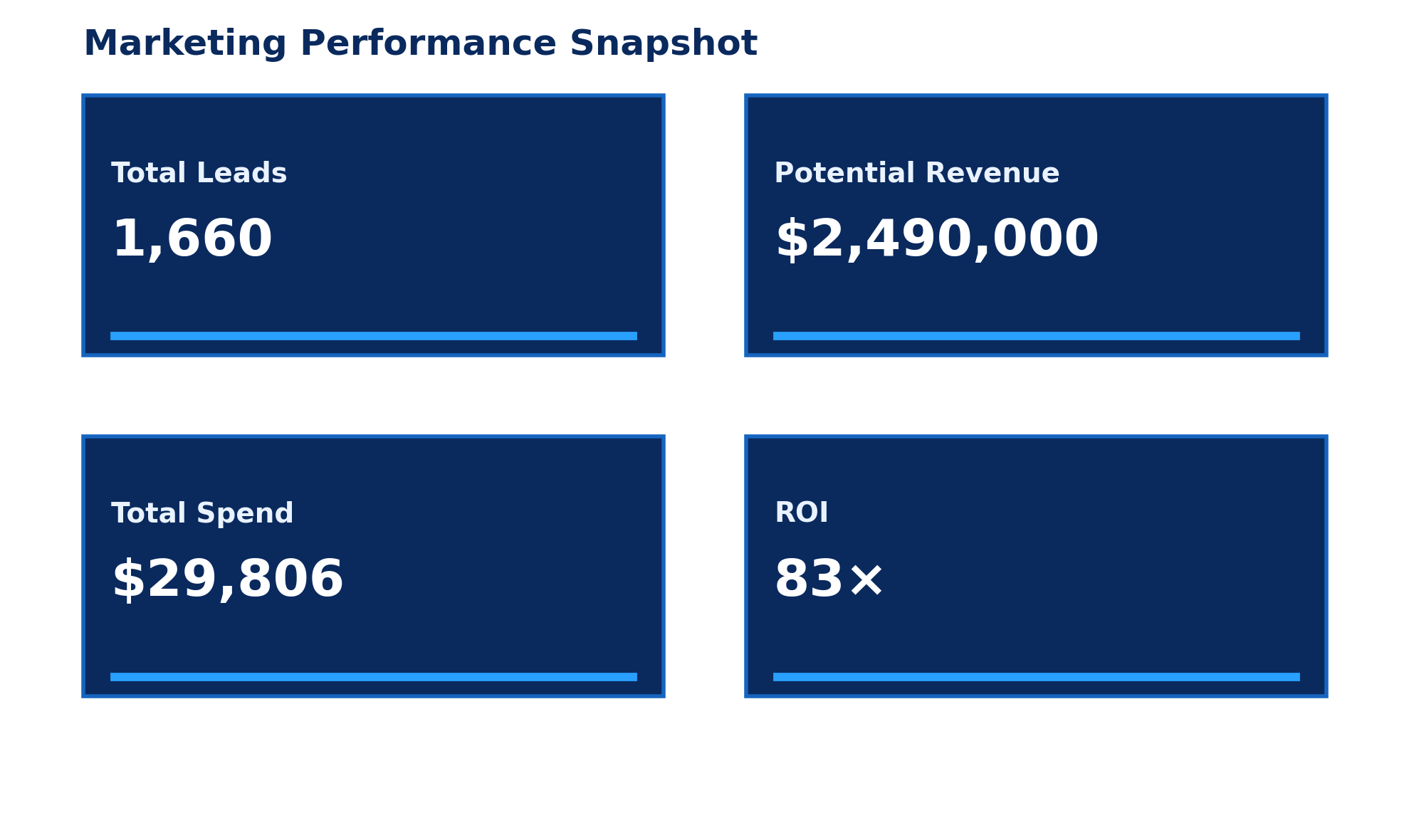

Leads

1,660

Potential Revenue

$2.49M

Total Spend

$29,806

ROI

82×

Key Efficiency Metrics

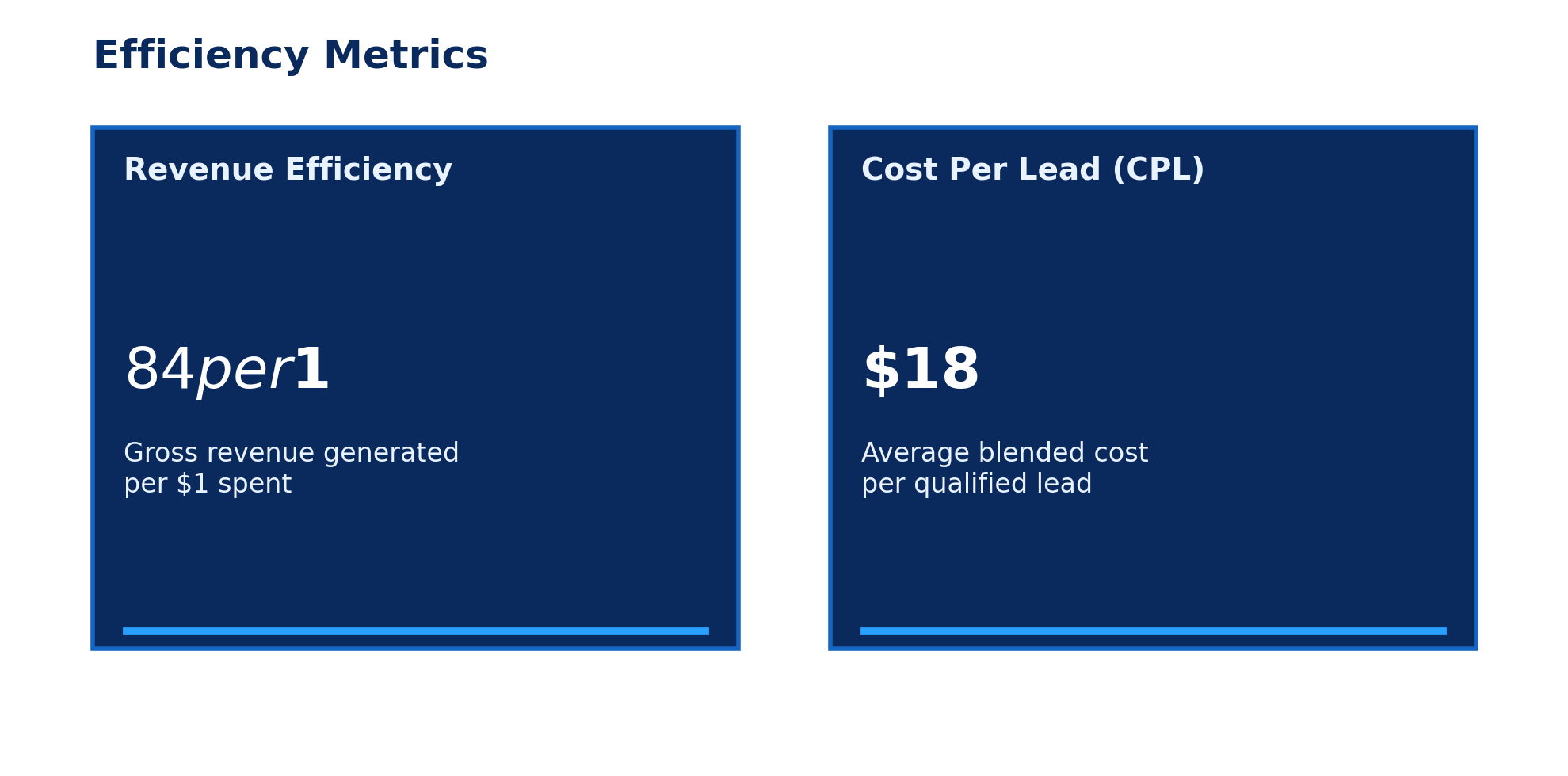

- Cost per Lead (CPL): ~$18 per lead

- Revenue Efficiency: ~$83 generated per $1 spent

- Payback: Acquisition costs recovered in under one month

- Average Rental Term: 4 months (driving $1,500 LTV)

The Impact

- PPC became a predictable, profitable growth engine.

- Management fees acted as an investment multiplier, not a sunk cost.

- Every $1 invested returned approximately $83 in potential revenue.

The Takeaway

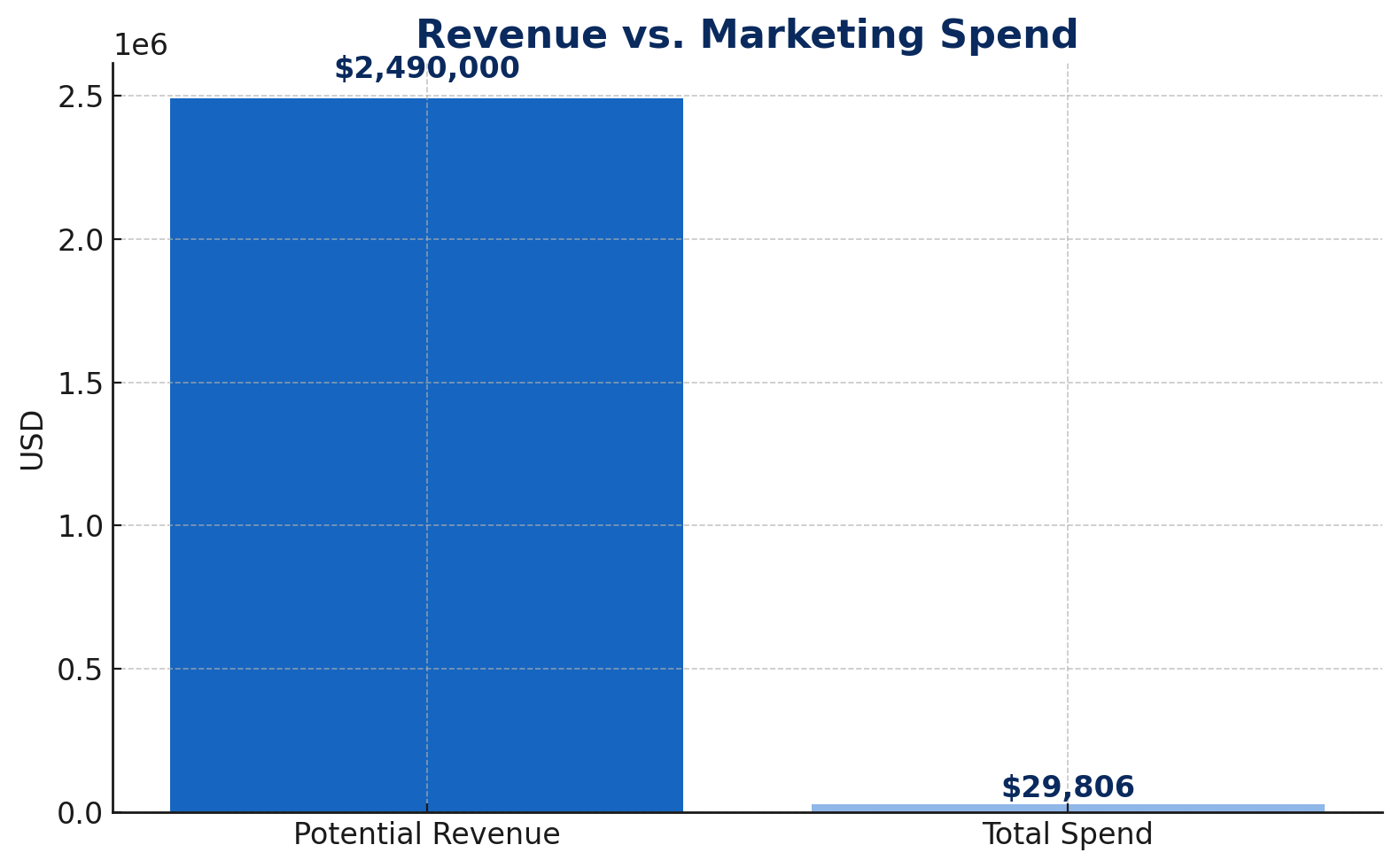

By connecting channel performance to customer value, JPS Develops helped transform paid media into a high-ROI acquisition program. From $29.8K in blended spend, the program generated $2.49M in potential revenue—an 82× ROI—while strengthening the client’s marketing confidence and budget efficiency.